Home Buying— Where to Begin Guide on Your Way to Homeownership.

The home-buying process can be quite overwhelming in the beginning, but always rewarding in the end. Here is a step by step to get you prepared if you are potentially looking to buy a home in the near future.

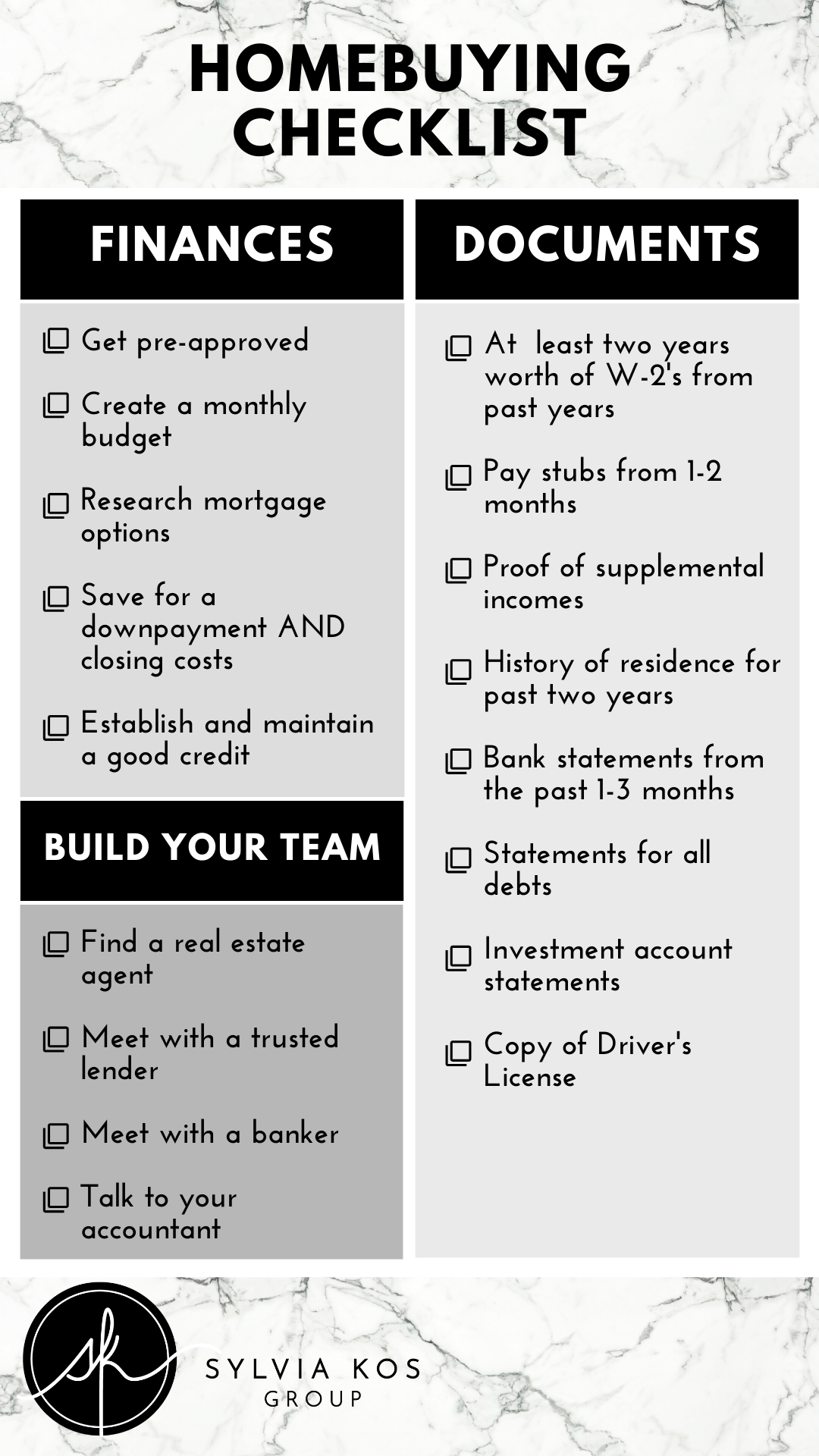

Finances

Getting pre-approved is the absolute first and foremost important part. What a lender or bank might lend you, and what you can comfortably afford are two different things. For example, a lender might say that based off of your debt to income ratio, your credit score, etc., we will lend you $400k. But after taxes, association (if appl.), insurance, your gym membership, sushi date nights, your student loan, car loan, etc., then you might actually be more comfortable with a payment in the $350k range.

There are so many different factors that come into play with the loan process hence why creating a monthly budget is also important to keep you focused, and on track. With a conventional loan *Typically* one puts down 20% (if you want to avoid paying mortgage insurance.) But again, when you talk to your lender, they will give you the best options of financing for you.

In the meantime, try to establish/maintain good credit. You can do that by:

- Pay your bills on time

- Dont close unused credit cards

- Apply for and open new credit accounts only as needed

For more tips on how to improve your credit score, visit How to Improve Your Credit Score.

Build your Team!

As your real estate professional, I will be more than happy to guide you through a smooth transaction from start to finish. I will set you up with a trusted lender that I have worked with time and time again. One lender is Marc Churchill from Prosperity Mortgage. He is currently offering $1000 if he cannot match or BEAT another competitor, and $10,000 if they do not close on time, (TALK ABOUT AN INCENTIVE!)

Taxes/Accounting+ Home buying

If you are thinking of buying a home this year, I would mention it to your accountant (especially if you are a LLC or a Corp). You want to make sure you write off enough, but not too much.

Gross Profit- Expenses= NET Profit. The less you show you NET, the smaller the pre-approval.

Also, if you are a small business, typically, it will take at least two years of filing taxes for a lender to approve you.

As ALWAYS, with any questions regarding any and all home buying needs, please feel free to contact me!